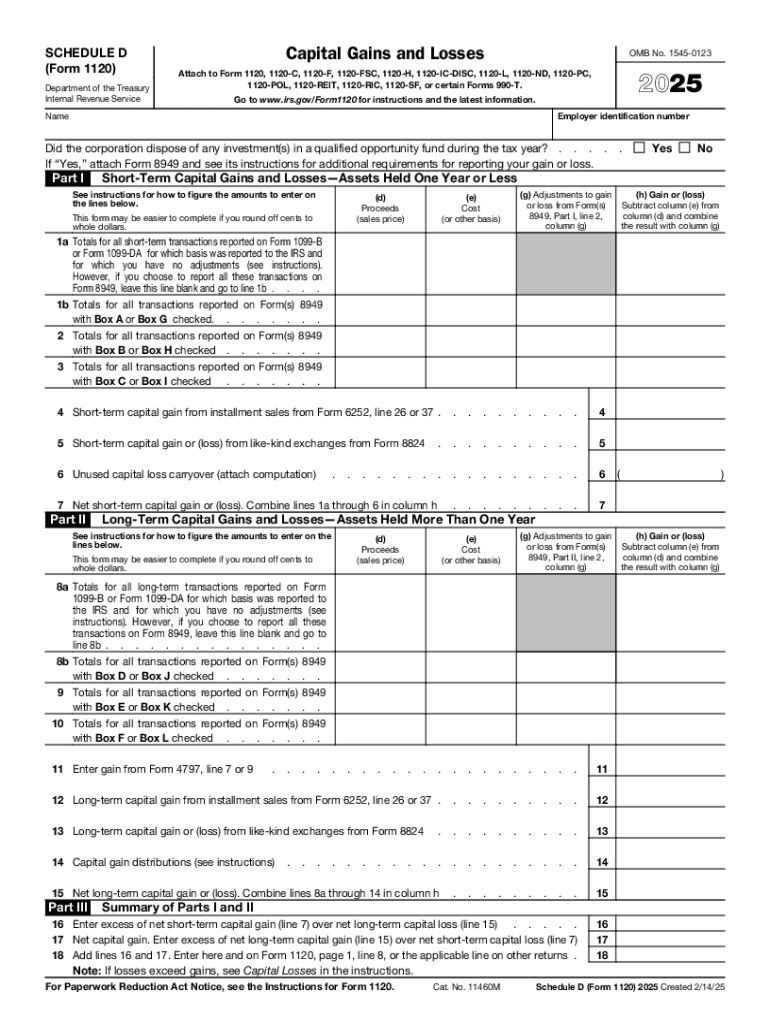

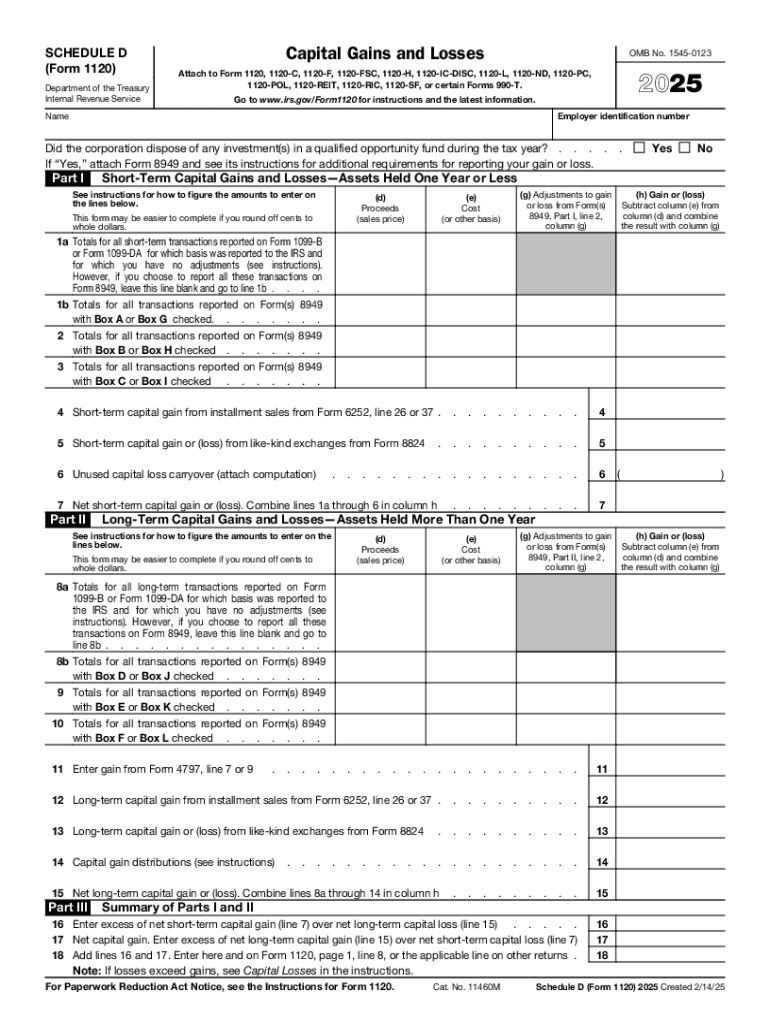

IRS 1120 - Schedule D 2025-2026 free printable template

Get, Create, Make and Sign IRS 1120 - Schedule D

Editing IRS 1120 - Schedule D online

Uncompromising security for your PDF editing and eSignature needs

IRS 1120 - Schedule D Form Versions

How to fill out IRS 1120 - Schedule D

How to fill out 2025 schedule d form

Who needs 2025 schedule d form?

A Comprehensive Guide to the 2025 Schedule Form

Understanding Schedule : Overview and Purpose

The 2025 Schedule D Form is a crucial document that taxpayers use to report capital gains and losses on their tax returns. It's essential for calculating taxable income, particularly when selling investments or property. Investors may encounter various forms of income from capital assets, which can significantly affect their overall tax liability.

For the tax year 2025, the IRS has implemented several updates to Schedule D that are vital for taxpayers to understand. Changes may include updated tax brackets or revised definitions of capital assets, impacting how gains and losses are reported. Understanding these nuances helps ensure accurate reporting and maximizes potential tax refunds.

Who needs to file Schedule ?

Schedule D must be filed by individuals who realize capital gains or losses from the sale of capital assets. This includes stocks, bonds, real estate, and even collectibles. A capital asset is generally any property that is not used in the ordinary course of a trade or business.

Specific scenarios requiring filing include selling shares of stock for profit or loss, selling a rental property that has appreciated or depreciated in value, or receiving payments from the sale of collectible items. If you've had any capital transactions during the tax year, you’ll need to address them in your 2025 Schedule D form.

Key components of the 2025 Schedule Form

The Schedule D Form is structured into different parts, each serving a specific purpose. The three main sections include:

Interactive tools for an easy experience

Utilizing pdfFiller’s interactive tools makes completing the 2025 Schedule D Form more manageable. Users can easily access and fill out the form online without needing to deal with physical paperwork.

The online platform is equipped with user-friendly features that can guide you through each section of the form, ensuring that no detail is overlooked. Follow these steps to use pdfFiller:

Detailed instructions for completing Schedule

Completing the 2025 Schedule D Form requires careful attention to detail. Here’s a step-by-step guide to ensure accuracy.

Avoid common mistakes such as misreporting transactions or not distinguishing between short-term and long-term holdings. These errors can result in inaccurate tax filings and potential refunds.

Navigating the eSignature process

Signing the 2025 Schedule D Form is a critical step to ensure its validity. eSigning through pdfFiller streamlines this process.

To eSign the document, follow these steps:

Adhering to best practices for document security is important. Use secure passwords and encrypt your pdf files to ensure your sensitive information remains protected.

Managing and storing your files securely

Organizing your tax documents, including the 2025 Schedule D Form, is critical to a smooth tax season. Proper file management can save time and prevent stress when deadlines approach.

Consider these tips for efficient tax document management:

By keeping your files organized and secure, you can easily access your completed 2025 Schedule D Form and other tax-related documents whenever needed.

Advanced tips for tax preparers and teams

For teams and tax preparers managing multiple Schedule D Forms, efficiency and accuracy are paramount. Streamlining the filing process can lead to significant time savings.

Consider the following tips:

By optimizing the workflow, tax professionals can better serve clients and enhance their overall experience during tax preparation.

Frequently asked questions (FAQs)

Taxpayers often have questions related to the 2025 Schedule D Form. Addressing these queries can clarify common concerns.

Preparing for tax season: best practices

Being proactive in tax preparation can simplify the filing process significantly. Here are best practices to consider as you approach tax season:

By adopting these strategies, you can make the most out of the tax season and ease the complexities associated with filing the 2025 Schedule D Form.

People Also Ask about

Is form 8949 necessary?

How do I get a Schedule D tax form?

What is the form 8949 for 2017?

Can Schedule D be completed without form 8949?

Do I use form 8949 or Schedule D?

What is form 8949 exception?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the IRS 1120 - Schedule D electronically in Chrome?

How can I edit IRS 1120 - Schedule D on a smartphone?

How do I edit IRS 1120 - Schedule D on an iOS device?

What is 2025 schedule d form?

Who is required to file 2025 schedule d form?

How to fill out 2025 schedule d form?

What is the purpose of 2025 schedule d form?

What information must be reported on 2025 schedule d form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.